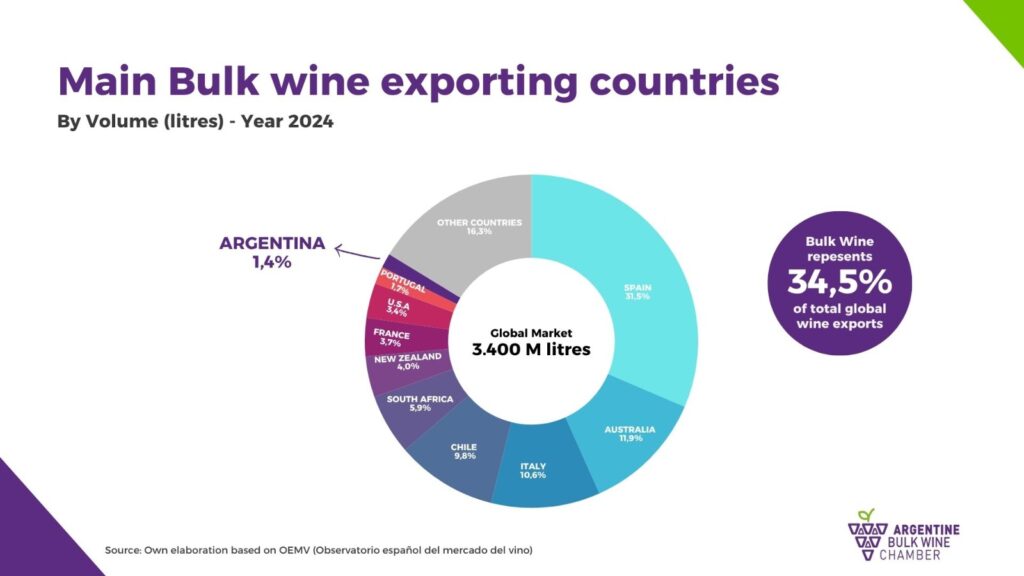

The bulk wine sector is responsible for moving a third of global exports, reflecting the importance of this marketing method. This sector’s share of global trade is not a passing phenomenon; on the contrary, it has remained stable over the last 25 years.

According to a report by the Argentine Bulk Wine Chamber, Bulk wine accounted for 34.5% of global wine exports in 2024, with a global market reaching 3.4 billion litres. Spain is the leading exporting country, with 31.5% of the total, followed by Australia (11.9%), Italy (10.6%), and Chile (9.8%). Far behind we come along South Africa, New Zealand, France, the United States, and Portugal, with Argentina in the 10th position, accounting for only 1.4% of global Bulk wine exports.

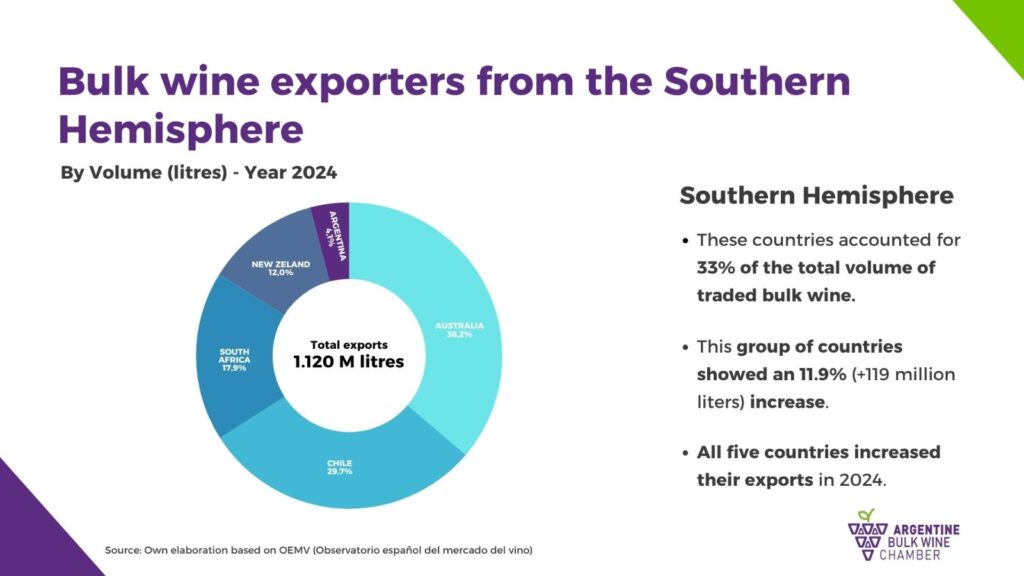

However, if we analyze Argentina, Australia, Chile, New Zealand, and South Africa as a cluster, these countries in the Southern Hemisphere form a highly significant export group. Not only due to their export volume, but also because of their ability to offer a wide variety of styles, consistent quality, and a harvest period that complements the Northern Hemisphere.

These countries represent 33% of global Bulk wine exports (1.12 billion liters in 2024), and supply the world’s main bottling and private label markets. Collectively, these countries increased their exports by approximately 12% last year.

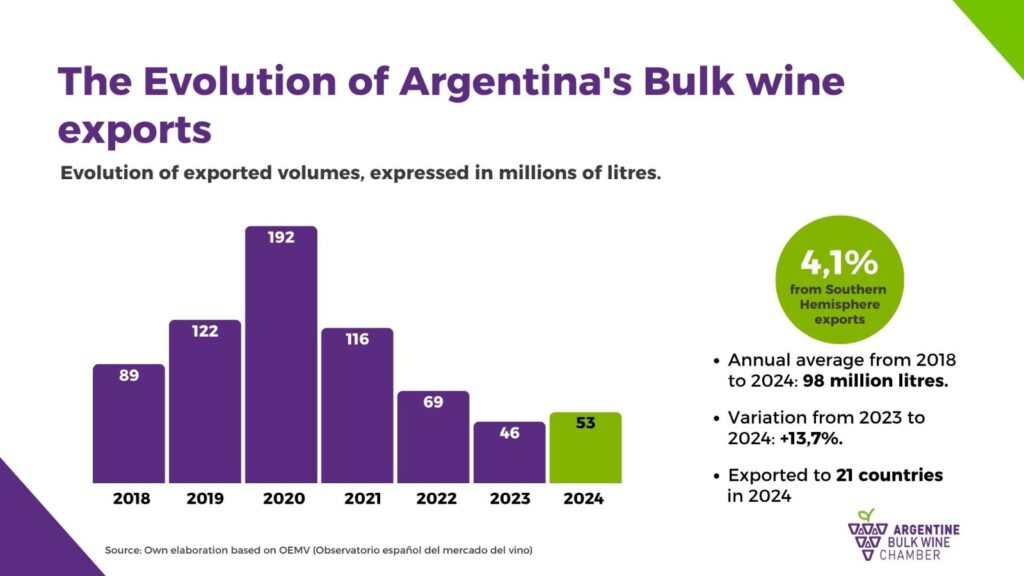

Argentina’s share of Bulk wine exports from the Southern Hemisphere is 4.1%. The average Bulk wine exports over the last five years was 98 million liters per year, reaching a peak in 2020 with 192 million liters and a low in 2023 with 45 million liters.

Argentina sells Bulk wine to 21 countries, but only six destinations represent 92% of our exports by volume: the United Kingdom (66.3%), the United States (9.5%), Germany (5.7%), France (4%), Canada (3.7%), and Sweden (3.3%).

These countries are also the ones that offer the best average prices per litre of bulk wine exported from Argentina, with the United Kingdom leading the way at an average price of $1.11 per litre, followed by Sweden at $1.02 per litre.

Argentina mainly exports varietal wines, which make up 90% of its exports. Malbec is the primary exported varietal, with a total volume of 46.3 million liters in 2024.

Chile

Our main competitor in the Southern Hemisphere is the neighbouring country, Chile. It has an average export volume of 330 million liters per year, which has remained stable at these annual values for the last five years. Chile exports Bulk wine to 36 destinations, but only four of them account for more than 60% of its foreign sales volume: the United Kingdom (21.5%), China (17.3%), the United States (13.2%), and Spain (8.9%).

These four countries are also the ones that offer the best average prices per litre of bulk wine. Considering that the average price of Chilean bulk wine is 0.75 cents per liter, the United Kingdom leads the way at an average price of $1.11 per litre, followed by Sweden at $1.02 per litre.

Argentina’s Competitive Disadvantages

Despite the high quality and diverse range of wines produced in Argentina, at least two structural factors are hindering the growth of Bulk wine exports:

The first factor is Freight. The distance between the production centres (Mendoza and San Juan) and the ports adds an additional cost to wine exports of about 8 cents per liter.

The second factor: Tariffs. Argentina has no trade agreements in place with its primary bulk importers. In Germany, Argentine wines are subject to a tariff of 10.09%, while in the United Kingdom this rate is 9.29%, and 9.57% in the United States. In contrast, Chile benefits from zero tariffs in all these bulk wine importing countries due to its trade agreements.